INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Exchange Act of 1934

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material pursuant to §240.14a-12 |

SANDY SPRING BANCORP, INC.(Name of Registrant as Specified in Its Charter)(Name of Person(s) Filing Proxy Statement, if other than the Registrant)Payment of Filing Fee (Check the appropriate box):x☒ No fee required.¨Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.(1)Title of each class of securities to which transaction applies:☐ (2)Aggregate number of securities to which transaction applies:(3)Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):(4)Proposed maximum aggregate value of transaction:(5)Total fee paid:¨Fee paid previously with preliminary materials: materials.☐ ¨Check box if any part of the fee is offset as providedFee computed on table in exhibit required by Item 25(b) per Exchange Act Rule 0-11(a)(2)Rules 14a6(i)(1) and identify0-11.

NOTICE OF ANNUAL

MEETING OF SHAREHOLDERS

| DATE | Wednesday, May 24, 2023 | |

| TIME | 10:00 a.m., Eastern Time | |

| PLACE | Manor Country Club, 14901 Carrollton Road, Rockville, MD 20853 | |

| RECORD DATE | You are eligible to vote if you were a shareholder of record at the |

MEETING AGENDA

| • | Elect four Class II directors to serve until the |

| • | ||

NOTICE OF 2018 ANNUAL MEETING OF SHAREHOLDERS TO BE HELD

Wednesday, April 25, 2018, 10:00 a.m.

Company Headquarters - Willard H. Derrick Building

17801 Georgia Avenue, Olney, MD 20832

The 2018 annual meeting of shareholders of Sandy Spring Bancorp, Inc., will be held as indicated above for the purpose of considering:

Approve amendments to the Articles of |

| • | Approve amendments to the Articles of Incorporation to eliminate the supermajority vote requirement for certain amendments |

| • | Vote, on an advisory basis, to approve the compensation for the named executive |

| • | Vote, on an advisory basis, to approve the |

| • | Ratify the appointment of Ernst & Young LLP as the company’s independent registered public accounting firm for 2023 |

| • | Transact such other business as may properly come before the meeting |

YOUR VOTE IS VERY IMPORTANT

YOUR VOTE IS VERY IMPORTANT

Please submit your proxy as soon as possible by internet, telephone, or mail. Submitting your proxy by one of these methods will ensure your representation at the annual meeting regardless of whether you attend the meeting. Instructions for voting by internet or telephone can be found on your proxy card or voting instruction form.

By order of the Board of Directors,

Aaron M. Kaslow

General Counsel, Chief Administrative Officer & Secretary

April 11, 2023

| | Notice and Proxy Statement | 2023 |

| | Notice and Proxy Statement | 2023 |

PROXY SUMMARY |

PROXY SUMMARY

This summary highlights information contained elsewhere in this proxy statement. This summary does not contain all of the information that you should consider in deciding how to vote your shares. Please read the entire proxy statement before voting. For information about our company’s performance, please review our 2022 Annual Report on Form 10-K.

You have received these proxy materials because our Board of Directors is soliciting your proxy to vote your shares during the 2023 annual meeting of shareholders. Notice of our annual meeting and this proxy statement were first sent or made available to shareholders on April 11, 2023.

2023 ANNUAL MEETING INFORMATION

For additional information about our annual meeting, see “Information About the Meeting” on page 63.

| | MEETING DATE: | May 24, 2023 | |

| | MEETING TIME: | 10:00 a.m. (Eastern) | |

| | RECORD DATE: | March 8, 2023 | |

| | MEETING LOCATION: | Manor Country Club, 14901 Carrollton Road, Rockville, MD 20853 |

Annual Meeting Admission. Admission to the annual meeting is limited to our registered and beneficial holders as of the record date and persons holding valid proxies from these shareholders. Admission to the annual meeting requires valid, government-issued photo identification. If you are not a shareholder of record, you must also present proof of your stock ownership as of the record date. The use of cameras, recording devices, phones, and other electronic devices is strictly prohibited. See “Information About the Meeting – Attending the Meeting” on page 63.

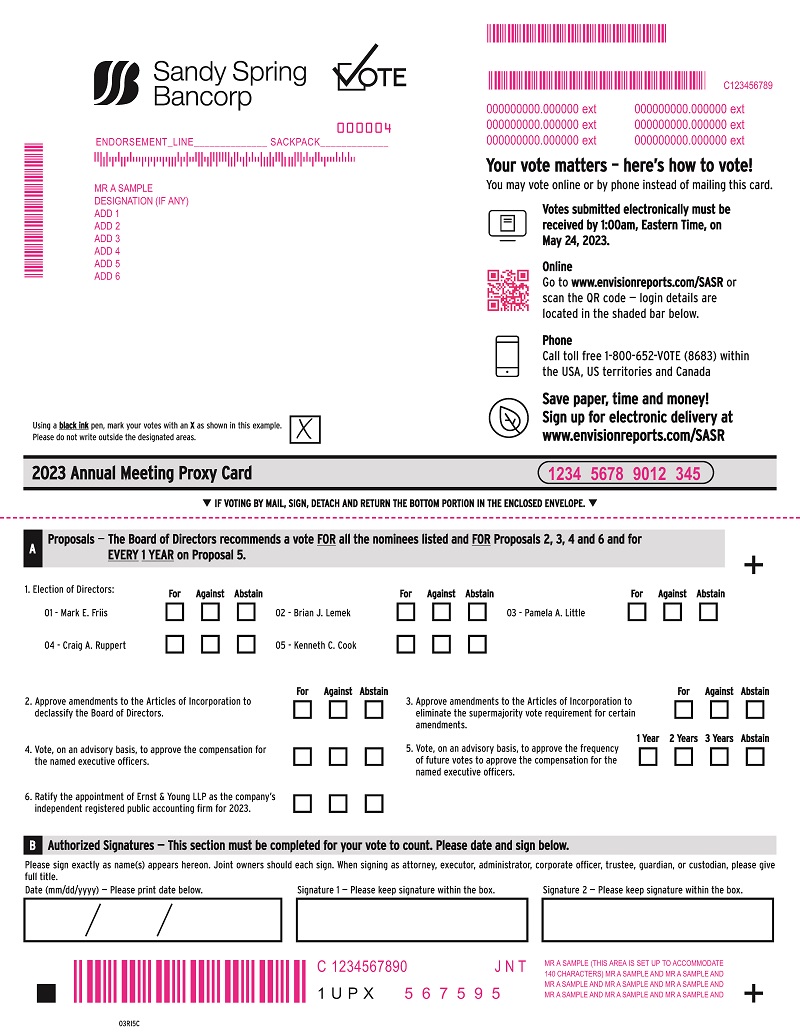

VOTING MATTERS AND BOARD RECOMMENDATIONS

Proposal | Board Recommendation | More Information | ||

1) Election of four Class II directors and one Class III director | ✓ “FOR” all nominees | Page 4 | ||

2) Approval of amendments to the Articles of Incorporation to declassify the Board of Directors | ✓ “FOR” | Page 55 | ||

3) Approval of amendments to the Articles of Incorporation to eliminate the supermajority vote requirement for certain amendments | ✓ “FOR” | Page 57 | ||

4) Advisory vote to approve the compensation for the named executive officers | ✓ “FOR” | Page 58 | ||

5) Advisory vote on the frequency of future votes to approve the compensation for the named executive officers | ✓ ONE YEAR | Page 59 | ||

6) The ratification of the appointment of Ernst & Young LLP as the independent registered public accounting firm for | ✓ “FOR” | Page 60 | ||

| | Notice and Proxy Statement | 2023 | 1 |

PROXY SUMMARY |

The board of directors established February 28, 2018, as the record date for this meeting. Shareholders of record as of the close of business on that date are entitled to receive this notice of meeting and vote their shares at the meeting and any adjournments or postponements of the meeting.HOW TO VOTE YOUR SHARES

Your vote is very important. The board urges each You may vote if you were a shareholder to promptly sign and return the enclosed proxy cardon March 8, 2023. Whether or to use telephone or Internet voting, as described on the card. Ifnot you chooseplan to attend the annual meeting, you may withdrawplease cast your proxy and vote in person.as promptly as possible using one of these methods:

| ||||

|

|

| ||

| Online before the meeting | By Phone | By Mail | ||

www.envisionreports.com/sasr (record holders) www.proxyvote.com (beneficial owners) | Call the phone number on your proxy card (record holders) or voting instruction form (beneficial owners) | Complete, sign, date and mail your proxy card (record holders) or your voting instruction form (beneficial owners) | ||

BOARD OF DIRECTORS

Name | Occupation | Age | Independent | Director Since |  |  |  |  |  | |||||||||

Mona Abutaleb Stephenson

|

CEO of Medical Technology Solutions, LLC

|

60

|

✓

|

2015

|

|

M

|

M

|

|

| |||||||||

Ralph F. Boyd

|

President and CEO of SOME, Inc.

|

66

|

✓

|

2012

|

|

|

C

|

M

|

M

| |||||||||

Kenneth C. Cook

|

Retired. Former EVP, President of Commercial Banking at Sandy Spring Bank

|

62

|

|

2023

|

|

M

|

|

|

| |||||||||

Mark E. Friis

|

Chair (former CEO) of Rogers Consulting, Inc.

|

67

|

✓

|

2005

|

|

C

|

|

M

|

M

| |||||||||

Brian J. Lemek

|

Owner of Lemek, LLC, a franchisee for Panera Bread bakery-cafes.

|

59

|

✓

|

2020

|

M

|

|

M

|

|

| |||||||||

Pamela A. Little

|

CFO of Nathan, Inc.

|

69

|

✓

|

2005

|

C

|

|

|

M

|

M

| |||||||||

Walter C. Martz II

|

Managing Member of Walter C. Martz LLC law firm.

|

71

|

✓

|

2020

|

M

|

|

|

|

| |||||||||

Mark C. Michael

|

Fellow at the Harvard Advanced Leadership Initiative

|

60

|

✓

|

2018

|

|

|

M

|

|

| |||||||||

Mark C. Micklem

|

Retired. Former Managing Director and Head of Financial Services Investment Banking at Robert W. Baird & Co.

|

64

|

✓

|

2019

|

M

|

M

|

|

|

| |||||||||

Christina B. O’Meara

|

President and founder of O’Meara Properties

|

69

|

✓

|

2020

|

|

|

M

|

|

| |||||||||

Robert L. Orndorff(1)

|

President and founder of RLO Contractors, Inc.

|

66

|

✓

|

1991

|

M

|

M

|

M

|

M

|

C

| |||||||||

Craig A. Ruppert

|

President and CEO of The Ruppert Companies

|

69

|

✓

|

2002

|

|

|

|

C

|

M

| |||||||||

Daniel J. Schrider(2)

|

President and CEO Sandy Spring Bancorp, Inc. and Sandy Spring Bank

|

58

|

|

2009

|

|

M

|

|

|

M

| |||||||||

Ages as of March 8, 2023

(1) Lead Independent Director

(2) Board Chair

M = Member

C = Chair

2 |

| | Notice and Proxy Statement | 2023 |

PROXY SUMMARY |

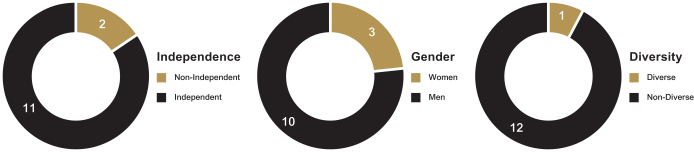

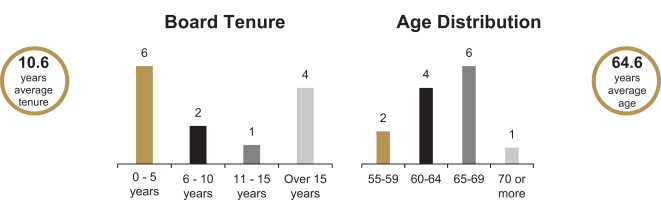

BOARD COMPOSITION

Important Notice Regarding the Availability of Proxy Materials for the

2018 Annual Meeting of Shareholders to be Held on April 25, 2018

This proxy statement and the 2017 Annual Report on Form 10-K are available at

www.envisionreports.com/sasr.

TABLE OF CONTENTS

GOVERNANCE HIGHLIGHTS

| | Notice and Proxy Statement | 2023 | 3 |

PROPOSAL 1: ELECTION OF DIRECTORS |

PROPOSAL 1: ELECTION OF DIRECTORS

Our Board of Directors currently has 13 members. Under our Articles of Incorporation and Bylaws, the Board is authorized to fix the number of directors, up to a maximum of 15. The Board currently is divided into three classes, with only one class of directors being elected each year and each class serving a three-year term. The Board has approved amendments to our Articles of Incorporation to declassify the Board so that directors are elected annually by shareholders. If these amendments are approved by shareholders (see Proposal 2 on page 55), nominees will be elected for a one-year term beginning in 2024.

The Board has nominated four Class II directors for election for a three-year term expiring in 2026. They are Mark E. Friis, Brian J. Lemek, Pamela A. Little and Craig A. Ruppert. The Board has also nominated Kenneth C. Cook for a two-year term expiring in 2025. All Class II director-nominees are incumbent directors who have been elected previously by the shareholders. Mr. Cook was appointed to the Board in October 2022 effective upon his retirement as an executive officer of the company on February 28, 2023. Each nominee has consented to be nominated and has agreed to serve, if elected. If any person nominated by the Board is unable to stand for election for any reason, the shares represented at our annual meeting may be voted for the election of another candidate as the present Board may designate, or our Board may choose to reduce its size.

BOARD DIVERSITY

Our Board values diversity (inclusive of gender, race and ethnicity) and seeks to include directors with a broad range of backgrounds, professional experience, perspectives and skills. In compliance with Nasdaq Listing Rules, the following chart shows the diversity of the Board:

| Board Diversity Matrix | ||||||||

Total Number of Directors | As of March 8, 2023 13 | As of March 9, 2022 12 | ||||||

| Female | Male | Female | Male | |||||

Gender Identity |

|

|

|

| ||||

Directors | 3 | 10 | 3 | 9 | ||||

Demographic Background |

|

|

|

| ||||

African American or Black |

| 1 |

| 1 | ||||

White | 3 | 9 | 3 | 8 | ||||

4 |

| | Notice and Proxy Statement | 2023 |

PROPOSAL 1: ELECTION OF DIRECTORS |

Sandy Spring Bancorp, Inc.DIRECTOR SKILLS

Proxy Statement

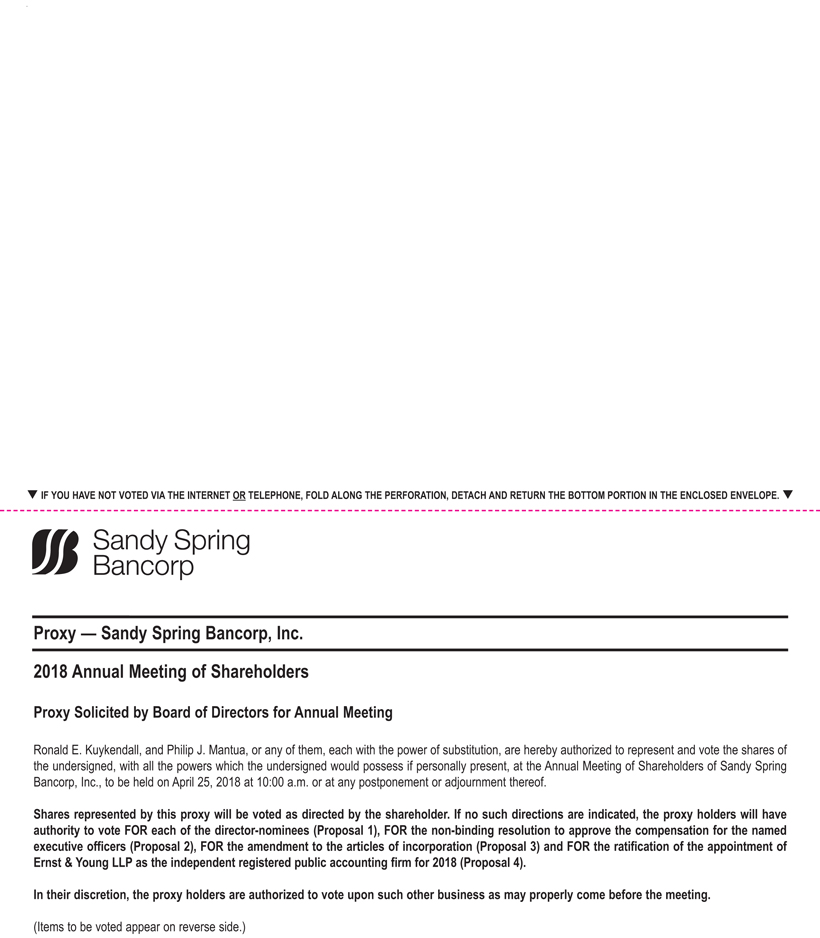

Our directors bring a balance of skills, qualifications and experience to their oversight of our company, as shown in the matrix below. The board of directors of Sandy Spring Bancorp, Inc., has furnished this proxy statementmatrix identifies certain skills, qualifications and experience that the Board believes are relevant to youour business. A director may possess other skills, qualifications and experience not indicated in connection with the solicitation of proxiesmatrix that may be relevant and valuable to be used at the 2018 annual meeting of shareholders (“annual meeting”) or any postponement or adjournment of the meeting. The notice of annual meeting is being first mailedtheir service on or about March 14, 2018 to shareholders of record as of the close of business on the record date. In this proxy statement, the “Company,” “Bancorp,” “we,” “our” or similar references mean Sandy Spring Bancorp, Inc., and its subsidiaries. The “board” refers to the board of directors of Sandy Spring Bancorp, Inc.

Proxy Summary

The following is an overview of information described in more detail throughout this proxy statement. This is only a summary, and we encourage you to read the entire proxy statement carefully before voting. For complete information about the Company’s performance, please review our 2017 Annual Report on Form 10-K.Board.

Voting Matters and Board Recommendations

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Abutaleb | Boyd | Cook | Friis | Lemek | Little | Martz | Michael | Micklem | O’Meara | Orndorff | Ruppert | Schrider | ||||||||||||||||||||||||||||||||||||||||||

SKILL/EXPERIENCE | Executive Leadership Experience in an executive leadership position provides the perspective required to understand and direct business operations, analyze risk, manage human capital, oversee implementation of organizational change, and develop and execute strategic plans. | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | |||||||||||||||||||||||||||||||||||||||||

Consumer Business and Financial Services Experience with consumer products and services or the financial services industry provides insight that assists the Board in overseeing the operation of our business and implementation of our strategic plan. | ¡ | ¡ | ● | ¡ | ¡ | ¡ | ¡ | ● | ¡ | ¡ | ¡ | ● | ||||||||||||||||||||||||||||||||||||||||||

Financial Reporting and Accounting Knowledge of or experience in accounting, financial reporting or auditing processes and standards assists the Board in overseeing our financial position and condition and ensuring accuracy and transparency in reporting. | ● | ¡ | ● | ¡ | ¡ | ● | ● | ● | ¡ | ¡ | ● | |||||||||||||||||||||||||||||||||||||||||||

Legal and Regulatory Understanding legal risks and obligations and experience with regulated businesses, regulatory requirements and relationships with regulators is important because we operate in a regulated industry. | ¡ | ● | ● | ¡ | ¡ | ● | ¡ | ¡ | ¡ | ¡ | ● | |||||||||||||||||||||||||||||||||||||||||||

Risk Management Risk is inherent in the operation of our business. Having directors with experience and expertise in risk management allows the Board to provide guidance in its independent oversight of the | ● | ¡ | ● | ¡ | ● | ● | ¡ | ¡ | ¡ | ¡ | ● | ● | ||||||||||||||||||||||||||||||||||||||||||

Technology/Information Security/Cybersecurity Experience with and understanding of technology, information systems and/or cybersecurity is important in overseeing our ongoing investment in and development of critical technology, as well as the | ● | ● | ¡ | ● | ● | ¡ | ¡ | ¡ | ¡ | ● | ||||||||||||||||||||||||||||||||||||||||||||

Human Capital Management Directors with an understanding of human capital management and compensation help the Board to effectively oversee our efforts to recruit, retain and develop key talent and provide valuable insight in determining compensation of the CEO and other executive officers. | ● | ¡ | ● | ¡ | ● | ● | ● | ● | ¡ | ¡ | ● | ● | ||||||||||||||||||||||||||||||||||||||||||

Commercial Real Estate/Market Knowledge Directors with experience in commercial real estate in our service area provide insight into our strategic planning, risk management, our market area and the needs of the local communities we serve. | ● | ● | ● | ● | ● | ¡ | ¡ | ¡ | ¡ | ● | ¡ | ● | ● | |||||||||||||||||||||||||||||||||||||||||

Public Company Governance Knowledge of public company governance practices and policies assists the Board in considering and adopting corporate governance practices, interacting with stakeholders and understanding the impact of various policies on our business. | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | |||||||||||||||||||||||||||||||||||||||||

| ● | Technical or Managerial Expertise – derived from direct and hands-on experience or director managerial experience with the subject matter during his/her career. | |

| ¡ | Working Knowledge – derived through Board or relevant committee membership at Sandy Spring or another company, executive leadership of a company in the relevant industry, consulting, investment banking, or private equity investing. | |

| | Notice and Proxy Statement | 2023 | 5 |

PROPOSAL 1: ELECTION OF DIRECTORS |

How To Cast Your Vote

Even if you plan to attend the annual meeting in person, please cast your vote as promptly as possible by following the instructions on the Notice of Availability of Proxy Materials and the proxy voting card using:

|  |  |

Summary of Governance Practices

The Company is committed to governance practices that support our long-term strategy, demonstrate high levels of integrity, and earn the confidence of investors.

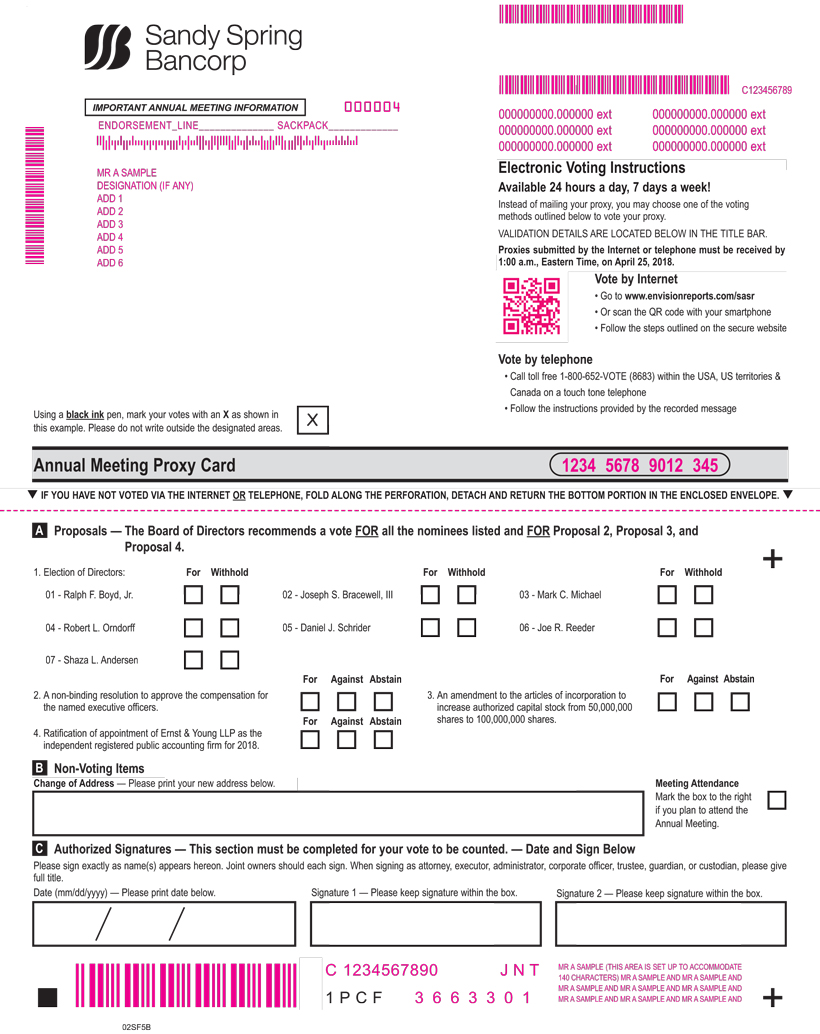

PROPOSAL 1: Election of Directors

The board is elected by the shareholders to represent their interest in the Company. With the exception of those matters reserved for shareholders, the board is the highest and ultimate decision-making authority. The board works closely with executive management and oversees the development and execution of our business strategy.

Board Complement

Our board currently has 15 members divided into three classes in equal number. In general, the term of only one class of directors expires each year, and the directors within that class are elected for a term of three years or until their successors are elected and qualified.

In connection with the acquisition of WashingtonFirst Bankshares, Inc., (“WashingtonFirst”) and the related merger of WashingtonFirst Bank into Sandy Spring Bank, the Company agreed to appoint four WashingtonFirst directors to the Company’s board. Upon completion of the acquisition on January 1, 2018, former WashingtonFirst Chairman Joseph S. Bracewell, former WashingtonFirst CEO and director Shaza L. Andersen, and WashingtonFirst directors Mark C. Michael and Joe R. Reeder joined the Company’s board. Also effective upon closing, director Susan D. Goff retired from the board after 23 years of dedicated service.

On December 13, 2017, the board of directors approved an amendment to the Company’s bylaws that permits a director to continue to serve on the board after the annual meeting of shareholders immediately following his or her seventy-second (72nd) birthday if (i) he or she was appointed to the board of directors in connection with a corporate acquisition, consolidation, or merger and (ii) the Nominating Committee and board of directors determine that his or her continued service would be of substantial benefit to the Company in recognizing the benefit of such acquisition, consolidation or merger. The board’s nomination of Mr. Bracewell (age 71) is made under this provision; and, if elected, Mr. Bracewell is expected to serve a complete term of three years.

Director-Nominees

A total of seven directors are nominated for election. Class I director-nominees are before you for election to a three-year term to expire in 2021: Ralph F. Boyd, Jr., Joseph S. Bracewell, Mark C. Michael, Robert L. Orndorff, and Daniel J. Schrider. Joe R. Reeder is nominated to Class II for a two-year term expiring in 2020, and Shaza L. Andersen is nominated to Class III for a one-year term expiring in 2019. All of these nominees currently serve on the board, and Mr. Boyd, Mr. Orndorff, and Mr. Schrider have been elected previously by the shareholders.

Nomination ProcessNOMINATION PROCESS

The Nominating and Governance Committee is responsible for recruitingidentifying, evaluating, and recommending candidates to the board. In exercising itsBoard a slate of nominees for election at each annual meeting of shareholders. All director nominees are expected to exhibit high standards of integrity and independence of thought and judgment, participate in a constructive and collegial manner, and be willing to devote sufficient time to carrying out the duties the committee considers the present skills and experience on the board and the qualifications that are desired in order to meet the Company’s changing needs.

Our Corporate Governance Policy outlines the general competencies required of all directors including the highest standards in exercising his or her duty of loyalty, care and commitment to all of our shareholders. Prior to the recruitmentresponsibilities of a new director the board gathers input from all directors in order to form a collective picture of the particular competencies needed to fulfill the board’s obligations and support our long-term strategy. Such competencies may include expertise in: the banking industry, financial matters, risk management, marketing, a geographic market, regional economics, strategic planning, executive management, technology or other relevant qualifications. The board also values diversity and seeks to include a broad range of backgrounds, experience and personality styles.

director.

The Nominating and Governance Committee encourages suggestionsassesses the skill areas currently represented on the Board, as well as those skill areas represented by directors expected to retire from the Board in the near future, against the skills matrix described above. The committee also considers recommendations from members of the Board regarding skills that could improve the overall ability of the Board to carry out its function. Based on this analysis, the committee targets specific skill areas or experience as the focus of consideration for qualifiednew directors to join the Board.

The Nominating and Governance Committee also considers whether the candidate would enhance the diversity of the Board in terms of gender, ethnicity, race, experience and skills.

The Nominating and Governance Committee may retain an independent search firm to assist with identifying director candidates, fromand individual Board members are encouraged to submit potential nominees to the chief executive officer, the chairmanChair of the board,Nominating and Governance Committee. The Nominating and Governance Committee has the sole authority to retain and terminate any search firm used to identify director candidates, including sole authority to approve its fees and the other directors, and from shareholders, and is responsible for the evaluationterms of such suggestions.its engagement. Shareholders may also submit suggestions for qualified director candidates by writing to Ronald E. Kuykendall, General Counsel andthe Corporate Secretary at Sandy Spring Bancorp, Inc., 17801 Georgia Avenue, Olney, Maryland 20832. Submissions should include information regarding a candidate'scandidate’s background, qualifications, experience and willingness to serve as a director. In addition, the Nominating Committee may consider candidates submitted by a third party search firm hired for this purpose. The Nominating and Governance Committee useshas not adopted any specific procedures for considering the recommendation of director nominees by shareholders, but will consider shareholder nominees on the same process for evaluating all nominees, including those recommended by shareholders, using the board membership criteria described above.basis as other nominees. Please see "Shareholder Proposals and Communications"“Proposals for the 2024 Annual Meeting of Shareholders” on page 42.

Information About Nominees and Incumbent Directors

The65 for important information below sets forth the names of the nominees for election describing their skills, experience and qualifications for election. Each has given his or her consentshareholders who intend to be nominated and has agreed to serve, if elected. If any person nominated by the board of directors is unable to stand for election, the shares represented by proxies may be votedsubmit a director nomination for the election2024 annual meeting of such other person or persons as the present board of directors may designate.shareholders.

Also provided is information on the background, skills, and experience of the remaining incumbent directors. Unless described otherwise, each director has held his or her current occupation for at least five years, and the ages listed are as of the Record Date.

Voting Standard for Uncontested ElectionsVOTING STANDARD FOR UNCONTESTED ELECTIONS

With respect to the election of directors, a pluralitymajority of all the votes cast at the annual meeting will be sufficientis required to elect a nominee as a director. In an uncontested election, an incumbent director-nominee who receives a greater number of votes “withheld” thanfails to receive more votes “for” shallthan “against” will promptly tender his or her resignation following certification of the shareholder vote. The Nominating and Governance Committee shallwill consider the resignation, taking into consideration any information it deems to be appropriate and relevant, and make a recommendation to the board.Board, which shall promptly disclose its decision and the basis for its decision.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE "FOR" EACH OF THE NOMINEES NAMED BELOW AS A DIRECTOR OF SANDY SPRING BANCORP, INC.

6 |

| | Notice and Proxy Statement | 2023 |

PROPOSAL 1: ELECTION OF DIRECTORS |

Class I Director-Nominees – For Terms To Expire at the 2021 Annual MeetingNOMINEES FOR ELECTION AND CONTINUING DIRECTORS

| THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE ELECTION OF EACH OF THE NOMINEES LISTED BELOW AS A DIRECTOR.

|

CLASS II DIRECTOR-NOMINEES – FOR TERMS EXPIRING AT THE 2026 ANNUAL MEETING

| MARK E. FRIIS |

| for developers, builders, institutions and corporations in the suburban Maryland region. Mr. | |

|

| BRIAN J. LEMEK | About Mr. Lemek is the founder and owner of Lemek, LLC, the franchisee for Panera Bread bakery-cafes in the state of Maryland. Lemek, LLC currently owns and operates over 50 locations. In 2010, Mr. Lemek founded Lemek Slower Lower LLC, which owns six Panera Bread Cafes in Southern New Jersey and Delaware. Mr. Lemek currently serves on the board of trustees of his alma mater, Saint Ambrose University in Davenport, Iowa, where he chairs the Building & Grounds Committee. | |

|

| | Notice and Proxy Statement | 2023 | 7 |

PROPOSAL 1: ELECTION OF DIRECTORS |

| PAMELA A. LITTLE | About Ms. Little is the Chief Financial Officer of Nathan, Inc., a | |

|

| CRAIG A. RUPPERT | About Mr. Ruppert is the founder, President and CEO of The Ruppert Companies, which is comprised of Ruppert Landscape, Inc., one of the largest commercial landscape construction and management companies in the US, located in seven states and the District of Columbia; Ruppert Nurseries, Inc., a premier large-caliper wholesale tree growing and moving operation in the eastern US; and Ruppert Properties, LLC, an industrial and office property development and management company in the Washington/Baltimore metropolitan region. A noted entrepreneur and philanthropist, Mr. Ruppert was inducted into the Washington Business Hall of Fame In 2021. | |

|

8 |

| | Notice and Proxy Statement | 2023 |

PROPOSAL 1: ELECTION OF DIRECTORS |

CLASS III DIRECTOR-NOMINEE – FOR TERM EXPIRING AT THE 2025 ANNUAL MEETING

| KENNETH C. COOK | About Mr. Cook retired in February 2023 as Executive Vice President and President of Commercial Banking for Sandy Spring Bank. Previously, Mr. Cook was Co-CEO of Revere Bank from 2010 to April 2020 when Revere Bank was acquired by Sandy Spring Bank. Prior to that time, he served as Regional President, Suburban Washington for PNC Bank from 2007 to 2010 and as President and CEO of Mercantile Potomac Bank from 1994 to 2007. | |

|

INCUMBENT CLASS I DIRECTORS – TERMS EXPIRING AT THE 2024 ANNUAL MEETING

| RALPH F. BOYD | About Mr. Boyd is the President and Chief Executive Officer for SOME, Inc. a Washington D.C. based inter-faith non-profit that provides emergency and food services, health care, substance abuse treatment and counseling, remedial education and employment training, and affordable housing with supportive services for seniors, veterans, and vulnerable individuals and families in our nation’s capital. Formerly, Mr. Boyd was Sr. Resident Fellow for Leadership and Strategy at the Urban Land Institute (ULI) from 2018-2020, and was CEO of ULI Americas from 2017-2018. Prior to that Mr. Boyd was CEO of the Massachusetts Region of The American Red Cross from | |

|

|

| 9 |

|

| WALTER C. MARTZ II | About

| estate administration to complex real estate and commercial banking transactions. Mr. | |

|

| |||

| MARK C. |

| In 2021, Mr. Michael | |

|

| ||||||||

10 |

|

|

|

|

| ROBERT L. ORNDORFF | About

| Mr. Orndorff is the founder and President of RLO Contractors, Inc., a leading residential and commercial excavating and grading company in central Maryland established in 1976. In 2002, RLO expanded to include a products division that | |

|

| DANIEL J. SCHRIDER |

|

|

Mr. Schrider has been part of Sandy Spring Bank for A leader among community bankers, Mr. Schrider |

|

| | Notice and | 11 |

PROPOSAL 1: ELECTION OF DIRECTORS |

Class II Director-NomineeINCUMBENT CLASS III DIRECTORS – For Term To Expire at the 2020 Annual MeetingTERMS EXPIRING AT THE 2025 ANNUAL MEETING

| ||||

| MONA ABUTALEB STEPHENSON |

|

|

Class III Director-Nominee – For Term To Expire at the 2019 Annual Meeting

|

| |

|

Incumbent Class II Directors - Terms Expiring at the 2020 Annual Meeting

| ||

| MARK C. MICKLEM |

| |

|

| ||||||||

12 |

|

|

|

|

| CHRISTINA B. O’MEARA | About

| a past land use chair for the Anne Arundel Trade Council. Ms. | |

|

| ||

|

|

| | Notice and Proxy Statement | 2023 | 13 |

CORPORATE GOVERNANCE |

Incumbent Class III Directors - Terms ExpiringCORPORATE GOVERNANCE

We are committed to strong corporate governance practices that promote the long-term interests of our shareholders and strengthen the accountability of our Board and management.

Our governance framework is set forth in our Corporate Governance Guidelines, committee charters and other key governance documents, which we review and modify on a regular basis to reflect best practices, recent developments, and legal and regulatory requirements. Our Corporate Governance Guidelines, committee charters and other key governance documents are available on our website atwww.sandyspringbank.com by selecting “Investor Relations” at the 2019 Annual Meetingtop of the page, then “Governance Documents” under “Governance Information.”

DIRECTOR INDEPENDENCE

Nasdaq Listing Rules require that a majority of our directors and each member of our Audit Committee, Compensation Committee and Nominating and Governance Committee be independent. In addition, our Corporate Governance Guidelines requires that a substantial majority of our directors be independent. A director may be determined to be independent only if the Board has determined that he or she has no relationship with the company that, in the opinion of the Board, would interfere with the exercise of independent judgment in carrying out the responsibilities of a director.

The Nominating and Governance Committee advises and makes recommendations to the Board regarding director independence. After considering the committee’s recommendation, the Board affirmatively determined that all current members of the Board, other than Mr. Schrider and Mr. Cook, are independent directors and independent for purposes of the committees on which they serve in accordance with applicable Nasdaq and Securities and Exchange Commission (SEC) independence rules and requirements. The Board determined that Mr. Schrider is not independent because he is employed as our President and Chief Executive Officer and Mr. Cook is not independent because he served as an employee of the company within the past three years.

To determine the independence of the directors, the Board considered certain transactions, relationships, or arrangements between those directors, their immediate family members, or their affiliated entities, on the one hand, and the company, on the other hand. Certain directors, their respective immediate family members, and/or affiliated entities have deposit or credit relationships with, or received investment or wealth management services from, Sandy Spring Bank or one of its subsidiaries in the ordinary course of business. The Board determined that all of these transactions, relationships, or arrangements were made in the ordinary course of business, were made on terms comparable to those that could be obtained in arms’ length dealings with an unrelated third party, were not criticized or classified, non-accrual, past due, restructured or a potential problem, complied with applicable banking laws, and did not otherwise impair any director’s independence.

BOARD LEADERSHIP STRUCTURE

Our Board is led by the Chair. Under our Bylaws, the Chair is elected annually by the Board from among the directors and presides over each Board meeting and performs such other duties as may be incident to the office of the Chair.

Daniel Schrider serves as our Chair, President and Chief Executive Officer. The Board believes that combining the Chair and the Chief Executive Officer roles at this time supports clear accountability, effective decision-making and execution of corporate strategy.

The Board recognizes the importance of independent oversight over management and has created the position of Lead Independent Director, who is elected by the independent members of the Board. The responsibilities of the Lead Independent Director, as set forth in our Corporate Governance Guidelines, include:

|

|

|

|

| Providing input to the Chair on Board meeting agendas, and adding agenda items in his or her discretion. |

| • |

|

| • | Providing input to the Chair on information submitted by management that is necessary or appropriate for the independent directors to effectively and responsibly perform their duties. |

| • | Facilitating communication between the Chief Executive Officer and the independent directors. |

| • | Functioning as a “sounding board” and advisor to the Chief Executive Officer on issues and other matters affecting the company. |

| • | If requested by major shareholders, being reasonably available for consultation or direct communication. |

In addition, under the charter of the Executive Committee, the Lead Independent Director chairs the committee when the Board chair is not independent.

14 |

|

|

|

|

Age: 71

Director since: 2010

|

Corporate Governance and Other Matters

BOARD COMMITTEES

The board remains committed to settingBoard has five standing committees: Audit, Compensation, Nominating and Governance, Risk and Executive. Each committee operates under a tone of the highest ethical standards and performance for our management, officers, and the Company as a whole. The board believes that strong corporate governance practices are a critical element of doing business today. To that end, the Corporate Governance Policy is reviewed regularly to ensure that it reflects the best interests of the Company and its shareholders. The policywritten charter, which may be found on our investor relations website atwww.sandyspringbank.com.

In addition, our board2022, the Board reorganized its committee functions by transferring oversight of directors has adopted a Code of Business Conduct (“Code”) applicablegovernance matters to all directors, officers, and employees of the Company and its subsidiaries. It sets forth the legal and ethical standards that govern the conduct of business performed by the Company and its subsidiaries. The Code is intended to meet the requirements of Section 406 of the Sarbanes-Oxley Act of 2002, related SEC regulations, and the listing rules of Nasdaq Stock Market, Inc. The Code of Business Conduct may be found on our investor relations website atwww.sandyspringbank.com.

The board of directors has affirmatively determined that all directors other than Mr. Schrider and Ms. Andersen are independent. In conjunction with the acquisition of WashingtonFirst, and effective as of December 29, 2017, the Company entered into a separation and consulting agreement with Shaza L. Andersen setting forth her entitlements under her employment agreement with WashingtonFirst in connection with her termination of employment with WashingtonFirst and her service as a non-employee director of and consultant to the Company. The separation and consulting agreement provides for a consulting period of 12 months and a consulting fee of $18,333.33 per month. The agreement was filed as an exhibit to Form 8-K on January 2, 2018.

The board complies with or exceeds the independence requirements for the board and board committees established by the Nasdaq Stock Market, federal securities and banking laws and the additional standards included in our Corporate Governance Policy.

Plurality Plus Resignation Policy

In response to feedback from our shareholder engagement efforts, the board revised the Corporate Governance Policy in 2017 to require an incumbent director to promptly submit a letter of resignation if he or she receives more “withhold” votes than “for” votes in an uncontested election at an annual meeting of shareholders. The resignation will be considered by the Nominating Committee which will make a recommendation toand renaming it the board.

Board Leadership Structure, EducationNominating and Self-Assessment Process

The Company’s bylaws provide forGovernance Committee. At the annual election of a chairman of the board from among the directors, and the Corporate Governance Policy states it is the board’s policy to separate the offices of the chairman and the chief executive officer. This separate role allows the chairman to maintain independence in the oversight of management. The chairman of the board also chairssame time, the Executive and Governance Committee (seebecame the Executive Committee.

| AUDIT COMMITTEE | The primary responsibility of the Audit Committee is to assist the Board in fulfilling its oversight responsibility for: • the integrity of the company’s accounting and financial statements and reporting processes; • the qualifications, independence, and performance of the independent auditors; and • the qualifications and performance of the company’s internal audit function. The Audit Committee is also responsible for: • the appointment, compensation, retention and oversight of the company’s independent auditors; • pre-approval of all audit and permissible non-audit services to be performed by the company’s independent auditors; • reviewing all major financial reports in advance of filing or distribution, including the company’s Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and quarterly earnings press releases; and • reviewing the effectiveness of the company’s system of internal controls. All members are financially literate as required by the Nasdaq listing rules. All members are independent and meet additional Nasdaq and SEC independence standards for audit committee members. The Board has determined that Pamela A. Little and Mark C. Micklem are each an audit committee financial expert as defined by the SEC. | |

Committee Chair: Pamela A. Little | ||

| ||

Other Committee Members | ||

Brian J. Lemek Walter C. Martz II Mark C. Micklem Robert L. Orndorff | ||

Meetings in 2022: 8 |

| COMPENSATION COMMITTEE | The responsibilities of the Compensation Committee include: • developing our executive compensation philosophy and reviewing and approving compensation and benefit programs applicable to the company’s executive officers, including base salary, incentive compensation, equity awards, and retirement benefits. • reviewing and recommending to the Board the compensation of the company’s non-employee directors; • assessing whether the company’s compensation programs generally are designed in a manner that does not encourage or reward unnecessary or excessive risk-taking; • administering the company’s equity compensation plans; • oversight of the company’s human capital management strategy, including initiatives on diversity, equity and inclusion, employee well-being and engagement; and • retaining and overseeing an independent compensation consultant to support the committee, approving related fees and engagement terms, and determining that the consultant’s work raises no conflicts of interest. All members are independent and meet additional Nasdaq and SEC independence standards for compensation committee members. | |

Committee Chair: Ralph F. Boyd | ||

| ||

Other Committee Members | ||

Mona Abutaleb Stephenson Brian J. Lemek Mark C. Michael Christina B. O’Meara Robert L. Orndorff | ||

Meetings in 2022: 7 |

| | Notice and Proxy Statement | 2023 | 15 |

CORPORATE GOVERNANCE |

| NOMINATING AND GOVERNANCE COMMITTEE | The responsibilities of the Nominating and Governance Committee include: • reviewing the composition of the Board at least annually to ensure the Board reflects the desired skills, experience, diversity, and other qualifications as well as affirming whether each director qualifies as “independent” as defined by Nasdaq Listing Rules; • recommending the appropriate size of the Board; • identifying, screening and reviewing individuals qualified to serve as directors, consistent with the criteria developed and approved by the Board; and • recommending to the Board for approval the candidates for nomination for election or re-election by the shareholders. • reviewing the company’s Corporate Governance Guidelines at least annually and making recommendations for updates; • oversight of the annual evaluation of the CEO and executive succession planning; • managing the Board’s process of annual evaluation; • oversight of ethics and business conduct; and • oversight of the company’s policies and practices on significant issues of corporate social responsibility including environmental, social, and corporate governance (ESG) and sustainability. All members are independent. | |

Committee Chair: Craig A. Ruppert | ||

| ||

Other Committee Members | ||

Ralph F. Boyd Mark E. Friis Pamela A. Little Robert L. Orndorff | ||

Nominating and Governance Committee Meetings in 2022: 1 | ||

Nominating Committee Meetings in 2022: 1 |

| RISK COMMITTEE | The Risk Committee assists the Board in its oversight of the company’s enterprise risk management. The responsibilities of the Risk Committee include: • monitoring the direction and trend of major risks relative to our business operations and strategies; • reviewing and recommending to the Board updates to our enterprise risk management structure and risk appetite statement at least annually; • reviewing and approving significant risk management policies and controls that reflect our risk management philosophy, principles, and limits consistent with the risk appetite statement; and • receiving comprehensive reports on enterprise level risk exposures and measurements, including relevant forecast information, and risk management programs including cybersecurity, business continuity, vendor management, and regulatory compliance. All members are independent, except for Mr. Schrider and Mr. Cook. | |

Committee Chair: Mark E. Friis | ||

| ||

Other Committee Members | ||

Mona Abutaleb Stephenson Kenneth C. Cook Mark C. Micklem Robert L. Orndorff Daniel J. Schrider | ||

Meetings In 2022: 6 |

16 |

| | Notice and Proxy Statement | 2023 |

CORPORATE GOVERNANCE |

| EXECUTIVE COMMITTEE | The Executive Committee is authorized to exercise the authority of the Board between regular meetings, except to the extent limited by law or the company’s charter documents. All members are independent, except for Mr. Schrider. | |

Committee Chair: Robert L. Orndorff | ||

| ||

Other Committee Members | ||

Ralph F. Boyd Mark E. Friis Pamela A. Little Craig A. Ruppert Daniel J. Schrider | ||

Executive and Governance Committee Meetings in 2022: 4 | ||

Executive Committee Meetings in 2022: 0 |

BOARD OVERSIGHT OF RISK

We believe that a strong risk management culture is vital to the success of our business. To mitigate the risks inherent in our business, we foster a culture that makes managing risk everyone’s responsibility at all levels of the company.

We have implemented a formal risk management framework that establishes the program by which we identify, assess, measure, monitor, report and control risks across the company. The risk management framework is designed to link risk appetite, and related risk monitoring and reporting, with our business strategy and capital plans. The risk management framework describes our risk management approach, including the adoption of the three lines of defense risk model, and outlines our risk management governance structure, including the roles of the Board, management, lines of business and internal audit. The Risk Committee reviews the risk management framework at least annually, or more often as needed to address changes in our risk profile or risk management best practices.

We have also adopted a risk appetite statement that identifies the level of risk we are willing to accept in pursuit of our strategic objectives. Our risk appetite is articulated through qualitative statements and quantitative metrics that cover the broad array of risks relevant to the company, including credit, market, liquidity, capital, operational, strategic and reputational risks. The Board reviews and approves our risk appetite statement annually. On a quarterly basis, we evaluate the risks facing the company and our risk appetite metrics against the risk appetite statement to ensure that our operations align with our risk appetite.

| | Notice and Proxy Statement | 2023 | 17 |

CORPORATE GOVERNANCE |

The Board is responsible for overseeing our risk management processes by informing itself about our material risks and evaluating whether management has reasonable risk management and control processes in place to address those risks. The Board oversees risk management through the actions of the Board, including approval and oversight of our risk appetite statement, strategic plan, capital plan and financial plan, and the activities of its committees.

| Board of Directors | ||||

Risk Committee | The Risk Committee has primary responsibility for overseeing our risk management framework. The committee reviews and approves our risk appetite statement, key risk management policies and the charter of the Executive Risk Committee, monitors compliance with the risk management framework and risk limits, and oversees the work of our risk management function. The committee oversees credit risk, including lending and credit policies and asset quality, financial risk, including interest rate risk, liquidity risk, capital risk and market risk, and operational risk, including compliance risk, business continuity planning, information and cyber security risk, and third-party risk. The committee receives a quarterly enterprise risk report as well as regular updates on key and emerging risks. The Risk Committee reports regularly to the Board regarding material matters discussed at meetings of the Risk Committee, as well as the current status of risk and action items. | |||

Audit Committee | The Audit Committee plays a significant role in the Board’s exercise of its risk oversight responsibilities. This committee has primary oversight of risks arising from our financial reporting, internal control processes and public disclosure. The Audit Committee reviews management’s assessment of our internal control over financial reporting, meets regularly with our independent auditors to discuss the results of their quarterly reviews and annual audit, and receives internal audit reports that enable it to monitor operational risk throughout the company. To ensure candid reporting, the Audit Committee meets in separate executive sessions with our independent auditors and Chief Internal Auditor. The committee coordinates any substantive or systemic findings with the Risk Committee through a liaison member who serves on both committees. The Audit Committee regularly reports to the Board on its risk management activities. | |||

Compensation Committee | The Compensation Committee has primary oversight of risks arising from our incentive compensation plans and programs. On an annual basis, the committee receives a risk assessment that enables the committee to determine whether our incentive compensation plans and programs create risks that are likely to have a material adverse effect or would encourage excessive risk-taking. | |||

Nominating and Governance Committee | The Nominating and Governance Committee oversees risks relating to our corporate governance structure, board leadership and effectiveness, and management and board succession planning. | |||

Board Oversight of Cybersecurity Risk

Our Board recognizes our responsibility to protect the data provided by our clients and employees, understands how cyber risks could disrupt our operations, and is cognizant of the increasing risks and threats associated with the use of digital technology. Through the efforts of the Risk Committee, the Board oversees our continuing efforts to strengthen our information security infrastructure and staffing and enhance our technology controls and cybersecurity defenses.

As part of its oversight of operational risk, the Risk Committee is responsible for the oversight of information security and cybersecurity risk management. Our Chief Information Security Officer regularly reports to the Risk Committee on security events, testing, training, audits, new system assessments and vendor performance. These reports address topics such as the threat environment and vulnerability assessments, results of penetration testing, results of key cyber risk indicators and performance metrics, and our efforts to detect, prevent and respond to internal and external critical threats. The Risk Committee receives periodic updates on information security risk, the maturity of our information security program, and updates on related investments and results. On an annual basis, the Risk Committee reviews and approves our information security program and information security policy.

18 |

| | Notice and Proxy Statement | 2023 |

CORPORATE GOVERNANCE |

ENVIRONMENTAL, SOCIAL AND GOVERNANCE MATTERS

Strengthening our communities through our products and services, investing in our communities and serving our neighbors and friends has always been at the heart of our mission as a community financial institution. As investors and the business community coalesce around the importance of environmental, social and governance issues (ESG), we are developing an approach to corporate and environmental sustainability that aligns with the nature of our business and the evolution of ESG principles in the financial services industry. In 2023, we published our third Corporate Responsibility Report, which summarizes our efforts and performance on ESG matters that we and our stakeholders view as among the most important to our business.

The Board has responsibility for overseeing policies, programs and strategies related to ESG matters and receives updates, at least annually, from management on ESG matters, including investor sentiment, our Corporate Responsibility Report, and ESG initiatives. Board committees also play an important role in oversight of ESG matters. The Nominating and Governance Committee description below), that is empowered to actoversees our policies and practices on behalfsignificant issues of corporate social responsibility and sustainability. The Compensation Committee assists the board between regular board meetings.Board in the oversight of our human capital management strategy, including strategies and initiatives on diversity, equity, and inclusion, employee well-being and engagement.

ENVIRONMENT | We recognize that we all have a role to play in environmental sustainability and combatting climate change. We foster sustainability by: • embracing digital tools to reduce paper usage and reliance on paper intensive processes • reducing waste and energy and resource usage in our facilities • financing clean energy and energy efficiency projects | |

SOCIAL | We believe that all members of our communities should have the opportunity to enjoy prosperous and fulfilling lives and that our success should enrich all stakeholders. We help lift up our clients and our communities by: • making financial products and services accessible and affordable • supporting area non-profit organizations that promote affordable housing, financial literacy, education, and health and wellness • volunteering with organizations across our footprint | |

PEOPLE | Attracting, retaining and developing a diverse, highly skilled workforce where employees feel included, respected and valued is key to our ability to deliver a remarkable client experience. We create a great place to work by: • building a diverse and inclusive workplace where all backgrounds, experience, interests and skills are respected, appreciated and encouraged • providing employees with opportunities to advance and grow their careers with our company through systematic talent management, career development and succession planning • delivering competitive compensation and benefits that exceed expectations | |

GOVERNANCE | We believe in strong governance and a culture of ethics and integrity in all that we do. We live these principles by: • adopting Corporate Governance Guidelines that promote sound and effective governance • adhering to a Code of Ethics and Business Conduct that sets expectations aligned with our core values • creating a culture of risk management in which managing risk is everyone’s responsibility at all levels of the company | |

| | Notice and Proxy Statement | 2023 | 19 |

CORPORATE GOVERNANCE |

2022 ESG HIGHLIGHTS

| $662K donated to 135 local nonprofits | Financing clean energy through Montgomery County Green Bank and DC Green Bank | |||

over 5,200 employee volunteer hours | Lent $187M to first-time home buyers | |||

| Launched low-cost Bank On certified account to reach un- and under-banked customers | 57% women in workforce | ||||

41% people of color in workforce |

| Formed employee teams to lead development of diversity, equity and inclusion plan | ||

Reduced purchased paper nearly 50% from 2019 level | Adopted majority vote standard for director elections | |||

For more detailed information, please see our Corporate Responsibility Report, which is available on our website at www.sandyspringbank.com. Information on our website is not incorporated by reference into this proxy statement. Additional disclosures about human capital management can be found in our 2022 Annual Report on Form 10-K filed with the SEC.

BOARD SELF-ASSESSMENT

The board is committed to self-improvement andBoard has established an annual self-assessment process that evaluates a different aspect of boardthe Board’s effectiveness each year. In 2017, that process was facilitated by The Center forOn a rotating basis, the directors evaluate the Board Excellence (“CBE”), an independent consultant. All directors completed an assessment ofas a whole, the Board committees, and individual director performance. The resultsself-assessment process, which is managed by the Nominating and Governance Committee, involves completion of the evaluation were compiled by CBE,annual surveys, review and a written report was given to the chairman. The chairman discussed the results with each director confidentially.

Board’s Role in Risk Oversight

The board fulfills a significant role in the oversightdiscussion of risk in the Company both through the actions of the board as a whole and those of its committees. The board’s Risk Committee has duties and responsibilities for broad risk oversight. The Risk Committee receives regular reports on: credit risk, asset quality, the adequacy of the allowance for loan losses, investment risk profiles, interest rate risk, liquidity, capital adequacy, cybersecurity, vendor management, corporate insurance, litigation management and regulatory compliance. The Compensation Committee reviews reports on risk to the Company associated with incentive compensation plans. The Audit Committee meets regularly with the independent registered public accounting firm to receive reports on the results of the auditsurveys by both the committee and review process.the Board, as well as with individual directors in the case of peer evaluations, and communication of feedback to management to improve policies, processes and procedures to support Board and committee effectiveness. In addition,2022, the Audit Committee receivesBoard completed an evaluation of individual director performance.

BOARD EDUCATION

We believe that continuing director education is essential to the ability of directors to fulfill their roles. We provide both internal audit reports that enable itand external educational opportunities and association memberships for our directors. We encourage directors to monitor operational risk throughoutparticipate in external continuing director education programs, and we reimburse directors for their expenses associated with such activities. Continuing director education also is provided during Board meetings and as stand-alone information sessions outside of meetings. Our Board hears from management as well as from subject matter experts on corporate governance and other matters relevant to Board service, including matters related to the Companyfinancial services industry.

BOARD AND COMMITTEE MEETING ATTENDANCE

During 2022, the Board held nine regular meetings and coordinatesone special meeting. In 2022, directors attended 96% of total Board and committee meetings, and each of the findings withdirectors attended at least 75% of the Risk Committee through a liaison member who servestotal meetings of the Board and the committees on both committees.which he or she served in 2022.

CORPORATE GOVERNANCE |

ANNUAL MEETING ATTENDANCE

Directors are expected to attend our annual meeting of shareholders. All of our directors serving at the time of the 2022 annual meeting attended the 2022 virtual annual meeting via teleconference.

CODE OF ETHICS AND BUSINESS CONDUCT

Our Board Committees

has adopted a Code of Ethics and Business Conduct (the Code) applicable to all directors, officers, and employees of the company. The boardCode of directors has the following standing committees: Audit, ExecutiveEthics and Governance, Nominating, Compensation, and Risk. The charter for each committeeBusiness Conduct may be found on our investor relations website atwww.sandyspringbank.com. Each committee’s function is described as follows:

Audit Committee - The Audit Committee is appointed by www.sandyspringbank.com. If we make any substantive amendments to the board to assist in monitoring: 1) the integrityCode or grant any waiver from a provision of the financial statements and financial reporting, includingCode that is required to be disclosed under the proper operation of internal control over financial reporting and disclosure controls and procedures in accordance with the Sarbanes-Oxley Act of 2002; 2) compliance with legal and regulatory requirements; and 3) the independence and performance of internal and external auditors. The Audit Committee is directly responsible for the appointment and oversight of the external auditor, including review of their qualifications and compensation. The Audit Committee reviews the quarterly earnings press releases, as well as the Forms 10-Q and 10-K prior to filing. All members of the committee meet all requirements and independence standards as defined in applicable law, regulationsrules of the SEC, Nasdaq listing rules,we will disclose the Federal Deposit Insurance Actnature of such amendments or waiver on our website or in a current report on Form 8-K.

STOCK OWNERSHIP REQUIREMENTS FOR DIRECTORS

Our Corporate Governance Guidelines require that directors own Sandy Spring stock equal in value to at least four times the annual cash retainer paid by us for service as a director. Non-employee directors are expected to meet this ownership requirement within four years of joining the Board and related regulations. The board has determined that Pamela A. Little qualifiesto retain all shares of Sandy Spring stock received pursuant to their service as an audit committee financial expert under the Nasdaq listing rules and applicable securities regulations.

Executive and Governance Committee - This committee conducts board business between regular meetingsa Board member for as needed and provides oversight and guidance to the board oflong as they serve as directors to ensure that the structure, policies, and processes of the boardcompany.

Compliance with the minimum stock ownership level is determined annually on each December 31 by multiplying the number of shares owned by the average closing price of Sandy Spring stock during the preceding 12-month period. Sandy Spring stock holdings that count toward meeting the ownership requirements include (i) shares owned directly or beneficially by the director or in the name of an immediate family member and its committees facilitate the effective exercise(ii) restricted shares and shares issuable upon settlement of restricted stock units.

All of the board's role in governingdirectors exceed the Company. The committee reviews and evaluates the policies and practices with respect to the size, composition, independence and functioningminimum ownership requirements of the boardpolicy.

PROHIBITION ON HEDGING AND PLEDGING

Under our Insider Trading Policy, our directors, officers and its committees as statedemployees may not at any time buy or sell options on company securities or other derivative securities that reference company securities and may not enter into hedging or similar transactions that are designed to offset any decrease in the Corporate Governance Policy. This committee ismarket value of company securities. In addition, our directors and executive officers are prohibited from trading company securities on margin, borrowing against any account in which company securities are held, or pledging company securities as collateral for any loan. Our policy also responsible for maintaining the Codeprohibits directors and executive officers from engaging in short sales of Business Conduct, the annual CEO evaluation process, and the annual board evaluation process.

Nominating Committee - Members of this committee are independent directors within the meaning of the Nasdaq listing rules. The Nominating Committee makes recommendations to the board with respect to nominees for election as directors. In exercising its responsibilities, the Nominating Committee considers general criteria and particular goals and needs of the Company for additional competencies or characteristics. The committee also has the authority to engage an outside search firm to source qualified candidates. See page 5 for a discussion of the nomination process.Sandy Spring stock.

| | Notice and Proxy Statement | 2023 | 21 |

DIRECTOR COMPENSATION |

Compensation Committee – Members of this committee are independent directors within the meaning of the Nasdaq listing rules. The Compensation Committee is responsible for developing executive compensation philosophy and determining all elements of compensation for executive officers including base salaries, short-term incentive compensation, equity awards, and retirement benefits. In addition, the committee considers other compensation and benefit plans on behalf of the board as required by regulation. The committee is charged with assessing whether the compensation plans encourage or reward unnecessary or excessive risk-taking by participants. The committee is also responsible for reviewing and making recommendations for non-employeeDIRECTOR COMPENSATION

Our director compensation program is designed to attract and administering the Company’s equity compensation plans.

Risk Committee – The Risk Committee is responsible for assisting the board in its oversight of the Company’s enterprise risk management, including the reviewretain highly qualified directors and approval of significant policies and practices concerning the various risks described in its charter as well as the analysis and assessment of potential risk in order to make recommendations to the board on strategic initiatives. The board delegates to the Risk Committee the oversight of specific risks as mandated by law or regulation, the authority to manage the Company’s affairsalign their interests with regard to risk and the authority to handle unresolved issues referred to it by the board for further deliberation and recommendation.

Current Board Committee Membership and Number of Meetings

| Name | Executive & Governance | Nominating | Audit | Compensation | Risk | |||||

| Number of meetings in 2017 | 5 | 2 | 8(1) | 7 | 6 | |||||

| Mona Abutaleb | X | X | ||||||||

| Shaza L. Andersen | X | |||||||||

| Ralph F. Boyd, Jr. | X | X | Chair | |||||||

| Joseph S. Bracewell | X | |||||||||

| Mark E. Friis | X | X | ||||||||

| Robert E. Henel, Jr. | X | X | Chair | |||||||

| Pamela A. Little | X | X | Chair | |||||||

| James J. Maiwurm | X | X | ||||||||

| Mark C. Michael | ||||||||||

| Gary G. Nakamoto | X | |||||||||

| Robert L. Orndorff(2) | Chair | X | X | X | X | |||||

| Joe R. Reeder | ||||||||||

| Craig A. Ruppert | X | Chair | ||||||||

| Daniel J. Schrider | X | X | ||||||||

| Dennis A. Starliper | X |

(1) The Audit Committee met four times in person, and four times by teleconference to approve quarterly earnings releases.

(2)As chairman of the board, Mr. Orndorff is an ex officio member of all committees.

Director Attendance at Board and Committee Meetings

Eachthose of our shareholders. We compensate our non-employeedirectors takes hiswith a combination of cash and her commitment to serve on the board very seriously as demonstrated by the superior attendance record achieved each year. During 2017, the board held 10 meetings with overall attendance averaging 96%. In accordance with the Corporate Governance Policy, all incumbent directors attended well over 80% of the aggregate of (a) the total number of meetings of the board of directors and (b) the total number of meetings held by all committees on which they served.

Attendance at the Annual Meeting of Shareholders

The board of directors believes it is important for all directors to attend the annual meeting of shareholders to show support for the Company and to provide an opportunity to interact with shareholders directly. It is our policy that directors should attend the annual meeting of shareholders unless unable to attend by reason of personal or family illness or other urgent matters. Allequity awards. Directors who are employees of our directors were in attendance at the 2017 annual meeting.

Cash Compensation

Only non-employee directors are compensatedcompany do not receive additional compensation for their service as boardBoard members.

The Compensation Committee is responsible for reviewingperiodically reviews our non-employee director compensation and will periodically commission a market comparison to ensureprogram. Any changes proposed by the Compensation Committee must be approved by the Board. During 2022, after consultation with the Compensation Committee’s independent compensation levels are appropriate and commensurate with peer companies. Suchconsultant, including an analysis was last completed in 2016. As a result annual retainers for directors were increased.

In 2017,of pay levels at the chairman received an annual cash retainersame peer companies used to evaluate the compensation of $52,000, and each non-employee director received an annual cash retainer of $25,000. The committee chairmen received an additional annual cash retainer as follows: Audit Committee $9,000;our named executive officers, the Compensation Committee $7,000; Executive and Governance $5,000; Nominating Committee $5,000; and Risk Committee $5,000. Boardrecommended changes to our director compensation program, which were approved by the Board. These changes, which targeted non-employee director compensation at the peer group median, included eliminating meeting attendance fees were fixed at $1,200 per board meeting and $1,000 per committee meeting.adjustments to cash and equity retainers.

Our non-employee director compensation program currently consists of the following:

Annual restricted stock unit grant | $ | 50,000 |

|

|

| |||

Annual cash retainer | $ | 50,000 |

|

|

| |||

Board chair annual cash retainer (if applicable) | $ | 55,000 |

|

|

| |||

Lead Independent Director annual cash retainer (if applicable) | $ | 55,000 |

|

|

| |||

Additional annual cash retainer for committee chairs: |

|

|

|

|

|

| ||

Audit Committee | $ | 20,000 |

|

|

| |||

Risk Committee | $ | 17,500 |

|

|

| |||

Compensation Committee | $ | 15,000 |

|

|

| |||

Nominating and Governance Committee | $ | 15,000 |

|

|

| |||

Additional annual cash retainer for committee members |

|

|

|

|

|

| ||

Audit Committee | $ | 10,000 |

|

|

| |||

Risk Committee | $ | 9,000 |

|

|

| |||

Compensation Committee | $ | 7,500 |

|

|

| |||

Nominating and Governance Committee | $ | 7,500 |

|

|

| |||

Directors are encouraged to attend all meetings in person unless the meeting is called by teleconference. Directors who attended a regular board meeting by phone were paid a reduced meeting fee of $500. Directors were not paid for limited-purpose teleconference meetings, and members of the Nominating Committee were not paid when the Executive & Governance Committee met on the same day. All directors of the Companyour company also serve as directors of Sandy Spring Bank, for which they diddo not receive any additional compensation.

Equity Compensation

On March 15, 2017, each director received aRestricted stock units vest on the first anniversary of the date of grant, of restricted stock valued at $25,000 of Company common stock. The restricted stock will vest over three years in equal increments, and vesting is acceleratedaccelerates upon the permanent departure from the boardBoard other than removal for just cause. Dividend equivalents are paid on the award when dividends are paid on shares of our common stock.

Director Fee Deferral PlanDEFERRED FEE ARRANGEMENTS

Directors are eligible to defer all or a portion of their fees under the Director Deferred Fee Deferral Plan. The amounts deferred accrue interest at 120% of the long-term Applicable Federal Rate, which is not considered “above market” or preferential. Except in the case of death or financial emergency, deferred fees and accrued interest are payable only following termination of a director's service. Indirector’s service, at which time the eventdirector’s deferral account balance will be paid in a director dies during active service, the Bank will pay benefits that exceed deferred fees and accrued interestlump sum. Mr. Orndorff is a party to a Directors’ Fee Deferral Agreement, under which deferrals ceased in 2004, pursuant to which his beneficiary would receive a death benefit equal to the extentgreater of the Bank owns an insurance policy in effect onprojected retirement benefit or the director’s life atcombined deferral account balance under the timetwo fee deferral arrangements should his death occur while actively serving as a member of death that pays a greater amount than the total of deferred fees and accrued interest.

Director Stock Purchase Plan

Each director has the option of using from 50% to 100% of his or her annual retainer fee to purchase newly issued common stock at the current fair market value at the time the retainer is paid in accordance with the plan. Directors make an annual election to participate in advance, and participation in the plan is ratified by the board.Board.

2017 Non-Employee Director Compensation

| Fees Earned or | All Other | |||||||||||||||

| Paid in Cash | Stock Awards | Compensation | Total | |||||||||||||

| Name | (1) | (2) | (3) | |||||||||||||

| Mona Abutaleb | $ | 43,400 | $ | 25,000 | $ | 1,169 | $ | 69,569 | ||||||||

| Ralph F. Boyd, Jr. | $ | 48,400 | $ | 25,000 | $ | 1,670 | $ | 75,070 | ||||||||

| Mark E. Friis | $ | 46,000 | $ | 25,000 | $ | 1,670 | $ | 72,670 | ||||||||

| Susan D. Goff | $ | 41,000 | $ | 25,000 | $ | 1,670 | $ | 67,670 | ||||||||

| Robert E. Henel, Jr. | $ | 54,000 | $ | 25,000 | $ | 1,670 | $ | 80,670 | ||||||||

| Pamela A. Little | $ | 56,000 | $ | 25,000 | $ | 1,670 | $ | 82,670 | ||||||||

| James J. Maiwurm | $ | 43,800 | $ | 25,000 | $ | 1,169 | $ | 69,969 | ||||||||

| Gary G. Nakamoto | $ | 43,200 | $ | 25,000 | $ | 1,670 | $ | 69,870 | ||||||||

| Robert L. Orndorff | $ | 88,000 | $ | 25,000 | $ | 1,670 | $ | 114,670 | ||||||||

| Craig A. Ruppert | $ | 47,000 | $ | 25,000 | $ | 1,670 | $ | 73,670 | ||||||||

| Dennis A. Starliper | $ | 45,000 | $ | 25,000 | $ | 1,670 | $ | 71,670 | ||||||||

22 |

| | Notice and Proxy Statement | 2023 |

DIRECTOR COMPENSATION |

2022 NON-EMPLOYEE DIRECTOR COMPENSATION

The following table shows the compensation received during 2022 by our non-employee directors.

Name | Fees Earned or ($) | Stock Awards(2) ($) | All Other ($) | Total ($) | ||||||||||||||||

Mona Abutaleb Stephenson | 61,675 | 50,033 | 2,487 | 114,195 |

|

|

| |||||||||||||

Ralph F. Boyd | 70,800 | 50,033 | 2,487 | 123,320 |

|

|

| |||||||||||||

Mark E. Friis | 74,800 | 50,033 | 5,487 | 130,230 |

|

|

| |||||||||||||

Brian J. Lemek | 60,425 | 50,033 | 2,496 | 112,954 |

|

|

| |||||||||||||

Pamela A. Little | 75,425 | 50,033 | 2,487 | 127,945 |

|

|

| |||||||||||||

Walter C. Martz II | 51,100 | 50,033 | 3,696 | 104,829 |

|

|

| |||||||||||||

Mark C. Michael | 49,525 | 50,033 | 2,487 | 102,045 |

|

|

| |||||||||||||

Mark C. Micklem | 61,550 | 50,033 | 2,543 | 114,126 |

|

|

| |||||||||||||

Christina B. O’Meara | 50,925 | 50,033 | 2,496 | 103,454 |

|

|

| |||||||||||||

Robert L. Orndorff | 120,050 | 50,033 | 2,487 | 172,570 |

|

|

| |||||||||||||

Craig A. Ruppert | 62,175 | 50,033 | 2,487 | 114,695 |

|

|

| |||||||||||||

| (1) | All or a portion of the reported cash compensation may be deferred under the Director Fee Deferral Plan. |

| (2) | On May 25, 2022, each director serving at the |

| (3) | Amounts in this column represent dividends paid on restricted |

| | Notice and Proxy Statement | 2023 | 23 |

TRANSACTIONS WITH RELATED PERSONS |

Stock Ownership RequirementsTRANSACTIONS WITH RELATED PERSONS